📅 Published on: 21 September 2025

“GST update 21 September 2025: PM Modi announces GST 2.0 with simplified tax slabs, reduced rates on essentials, and new 40% GST on luxury items, effective from 22 Sept.”

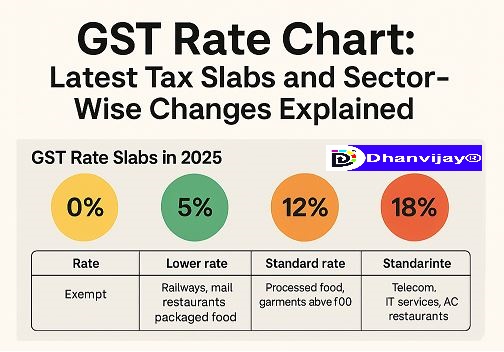

On 21 September 2025, Prime Minister Narendra Modi announced a major overhaul of India’s Goods and Services Tax (GST) system. Known as GST 2.0, the new tax regime will take effect from 22 September 2025. It replaces the existing four-rate structure (5%, 12%, 18%, 28%) with a simplified two-rate system: 5% and 18%.

This historic reform aims to ease compliance for businesses and reduce the cost of living for millions of Indian consumers.

🛒 What Gets Cheaper? Essential goods like soaps, toothpaste, and basic medicines will now attract lower GST rates. Meanwhile, life-saving drugs for cancer and chronic diseases have been fully exempted from GST, as confirmed by the Ministry of Health and Family Welfare.

🚫 What Gets Costlier? Luxury items and harmful products such as tobacco, aerated drinks, and high-end vehicles will now be taxed at a new 40% GST rate, based on retail sale price (RSP).

🏢 Impact on Businesses: Leading brands like Amul and Yamaha have already announced price reductions to pass on the benefits. Businesses must update billing systems and tax classifications accordingly.

This reform supports the government’s broader push for economic simplification and “Ease of Living” across India.

In a landmark announcement today, Prime Minister Narendra Modi unveiled a major overhaul of India’s Goods and Services Tax (GST) system. Dubbed as GST 2.0, the new structure aims to simplify tax rates, reduce the burden on middle-class families, and support domestic consumption and manufacturing.

Here’s everything you need to know about the GST update on 21 September 2025 and what changes from 22 September 2025.

🔍 Key Highlights of the GST Reform 2025

✅ Two-Tier GST Rate Structure Introduced

- PM Modi confirmed that the current 4-slab GST system (5%, 12%, 18%, 28%) will be replaced by a simpler two-rate structure: 5% and 18%.

- This move is aimed at making compliance easier for businesses and providing relief to consumers.

🧾 Special 40% GST on Luxury and Sin Goods

- Items like tobacco, pan masala, luxury cars, and high-end electronics will now be taxed at a special 40% GST rate.

- These items will also be taxed based on their Retail Sale Price (RSP) instead of the ex-factory price.

📉 What Gets Cheaper Under New GST Rules

- Essential FMCG items such as:

- Soap, toothpaste, detergents

- Hair oil, sanitary pads

- Basic kitchen appliances

- Small vehicles and two-wheelers under a certain engine capacity will now fall under the 18% slab instead of the previous 28%.

- 33 Life-saving medicines including cancer drugs are now exempted from GST.

- Companies like Amul and Yamaha have already announced price cuts to pass the GST benefits to customers.

💡 Why This Reform Matters

According to PM Modi:

“This GST reform is a step towards Ease of Living. The common man should not suffer due to complex tax systems. A simplified GST helps both our consumers and our economy.”

📌 Impact on Consumers & Businesses

| Category | Old GST Rate | New GST Rate | Benefit |

|---|---|---|---|

| Daily Essentials | 12–18% | 5% | Cheaper prices |

| Two-Wheelers <350cc | 28% | 18% | ₹5,000–₹10,000 lower prices |

| Life-saving Drugs | 5% | 0% (Exempted) | Major health benefit |

| Luxury Cars | 28% + cess | 40% | Higher tax |

📣 GST Appellate Tribunal to be Operational Soon

PM Modi also confirmed the upcoming activation of the GST Appellate Tribunal (GSTAT) to improve dispute resolution and reduce litigation for businesses.

📢 Final Word: A People-Centric Reform

The GST update of 21 September 2025 marks a major turning point in India’s tax system. With GST 2.0, the government has taken a big step toward simplifying the tax regime, reducing costs on essentials, and promoting fair pricing.

This reform aligns with the government’s push for “Ease of Living” and a more consumer-friendly tax system. For full details, visit the official GST portal.